A Value Investing Platform & Community

Find companies within your circle of competence, research it financial statements, and do valuations with a margin of safety.

Value Investing

Our identity

We follow a value investing approach guided with it principles and margins.

Our north star

Most framework use stock price as their main metric, we managed risk by calculating Intrinsic Value per Share.

Stock Price / Intrinsic Value

With the help of the intrinsic value we buy low and sell high.

Simple Strategy

By calculating the intrinsic value, you can buy at a fair price, hold and let it compound and sell when is overvalued.

Research made easy

We manage investments thorough remarkable research.

Using multiple platform in one research

Financial data is scattered across multiple sources, requiring analysts and investors to juggle between platforms/accounts and subscriptions.

Complex Analysis Tools

Valuation models and fundamental analysis tools with a steep learning curves.

Information Overload

Users struggle to identify which metrics and data points are most relevant.

Redefining financial research

We empower analysts and investors with cutting-edge financial tools, and seamless data access

Decision Paralysis and Knowledge Gap

Too many investment options without clear guidance. And, individual investors lack the financial expertise of professionals.

Complex Valuation Models

Building and maintaining accurate valuation models requires significant expertise and manual effort, making them prone to human errors and inconsistencies.

Time-Consuming Research

Manual tasks like data collection,running macros that takes long time, using multiple tools and building reports and analysis is extremely time-intensive.

Everything you need

For business analysis, valuations and research.

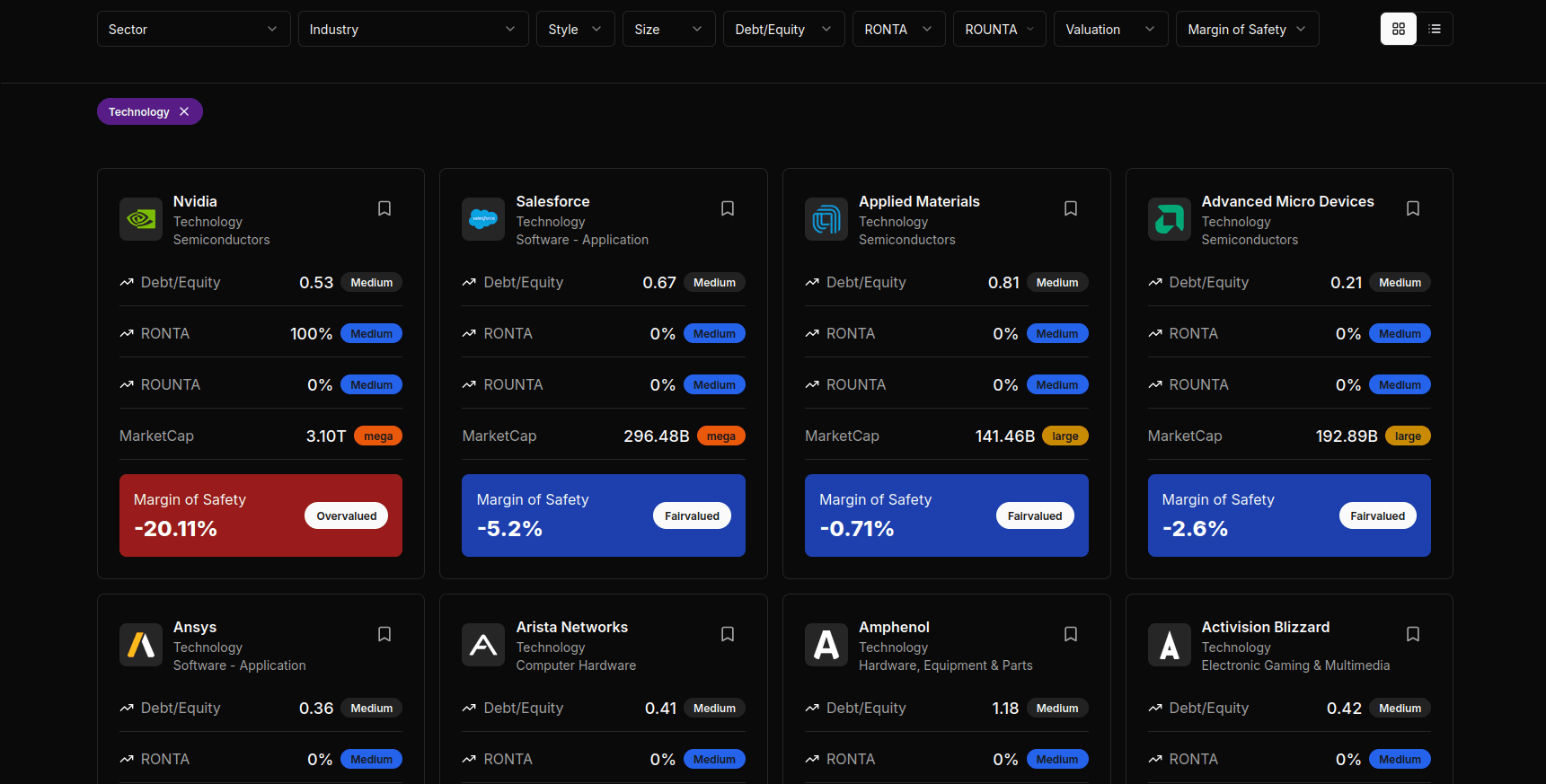

Circle of Competence

Focus on sectors and industries where you have an edge on and save time and energy screening out thousands of unworthy companies.

Fundamental Analysis

Research Capital Allocation, Ownership, and Financial Statements thoroughly. We build business stories from facts.

Valuations

Based on Owner-Earnings (CAGR) and your expected return (discount-rate), calculate the intrinsic value of a business.

Margins Of Safety

By buying business at a significant discount to their intrinsic value we mitigate investors' risk and ensure potential profits.

Opportunity Cost

Invest your money wisely by prioritizing, and identifying wonderful businesses with lower risks, and better returns.

Stock Watchlist

Organize and track your favorite companies based on different categories such as growth, income, blend, or industry.

Alerts & Notifications

Real-time alerts for buying and selling based on intrinsic value previously calculated and stock watchlist target prices.

Portfolio Management

Setting investment goals, strategies, criteria for asset selection, and monitoring parameters to achieve desired outcomes.

Long-term Investing

Encouraging investors to focus on the long-term potential of their investments not just increase their chances for return returns but also reduce their tax liability.